Apple has seen customers save more than $10 billion in its Apple Card high-yield Savings account, offered by Goldman Sachs. The milestone shows that the feature is pretty popular with Apple Card users and that it’s seeing good adoption.

One of the most appealing aspects of the high-yield savings account is that it offers an Annual Percentage Yield (APY) of 4.15 percent. This allows customers to better keep up with inflation which is eating into everybody’s spending power. It also helps customers who earn Daily Cash rewards to grow their savings.

Commenting on the milestone, Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet, said:

‘With each of the financial products we’ve introduced, we’ve sought to reinvent the category with our users’ financial health in mind. That was our goal with the launch of Apple Card four years ago, and it remained our guiding principle with the launch of Savings.’

‘With no fees, no minimum deposits, and no minimum balance requirements, Savings provides an easy way for users to save money every day, and we’re thrilled to see the excellent reception from customers both new and existing.’

Apple sees customers save $10 billion in its high-yield Savings product

Paul Hill · Aug 2, 2023 18:36 EDT2

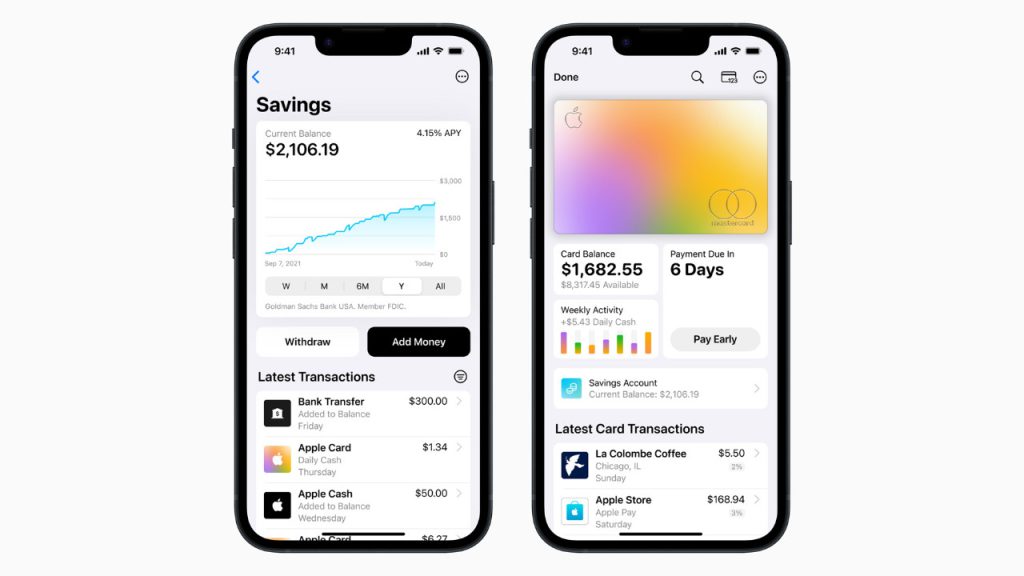

Two iPhones running Apple Cards dashboard with savings accounts

Apple has seen customers save more than $10 billion in its Apple Card high-yield Savings account, offered by Goldman Sachs. The milestone shows that the feature is pretty popular with Apple Card users and that it’s seeing good adoption.

One of the most appealing aspects of the high-yield savings account is that it offers an Annual Percentage Yield (APY) of 4.15 percent. This allows customers to better keep up with inflation which is eating into everybody’s spending power. It also helps customers who earn Daily Cash rewards to grow their savings.

Commenting on the milestone, Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet, said:

‘With each of the financial products we’ve introduced, we’ve sought to reinvent the category with our users’ financial health in mind. That was our goal with the launch of Apple Card four years ago, and it remained our guiding principle with the launch of Savings.’

‘With no fees, no minimum deposits, and no minimum balance requirements, Savings provides an easy way for users to save money every day, and we’re thrilled to see the excellent reception from customers both new and existing.’

Apple claims that 97 percent of Savings customers have chosen to send their Daily Cash automatically to their Savings account. Other options for funding the account include sending transfers from a linked bank account and adding funds from the Apple Cash balance.

Also providing comment on the milestone was Liz Martin, Goldman Sach’s head of Enterprise Partnerships:

‘We are very pleased with the success of the Savings account as we continue to deliver seamless, valuable products to Apple Card customers, with a shared focus on creating a best-in-class customer experience that helps consumers lead healthier financial lives.’

To get started with Apple Card Savings, open up Apple Card from the Wallet app and tap More, select Daily Cash, tap Set Up Savings, and follow the onscreen instructions. You can then link a bank account to deposit money and earn interest over time.

Source: Apple